Accurate financial tracking and analysis are crucial for the success of any business or individual. In today's fast-paced world, it can be challenging to keep track of your finances manually. This is where an Excel template comes into play. With a budget vs actual Excel template, you can easily track your financial data, analyze it, and make informed decisions to improve your financial position.

In this article, we will explore the ins and outs of using a budget vs actual Excel template for financial tracking and analysis. We will delve into the key components of an effective template, how to use it, and the benefits of customization. Additionally, we will share tips, tricks, and best practices to ensure that your financial tracking is efficient and accurate.

Key Takeaways:

- A budget vs actual Excel template is an excellent tool for effective financial tracking and analysis.

- An Excel template helps you to streamline your overall financial tracking process, allowing you to focus on growing your business or achieving your financial goals.

- Customizing your budget vs actual Excel template to suit your specific financial tracking needs and preferences can help you optimize your financial tracking and analysis.

- Integrating your budget vs actual Excel template with other financial management tools can help you streamline your financial tracking process.

- Advanced financial analysis, including identifying trends and making informed decisions, is possible with a budget vs actual Excel template.

What is Budget vs Actual Tracking?

Budget vs actual tracking is a financial management practice that involves comparing actual expenses and income against the budgeted amounts. It is used to monitor the performance of a business or an individual's finances and identify areas where adjustments need to be made.

Using budget vs actual tracking provides an accurate picture of financial status and helps to make informed decisions. It is a crucial aspect of financial planning and helps to ensure that available resources are used effectively and efficiently.

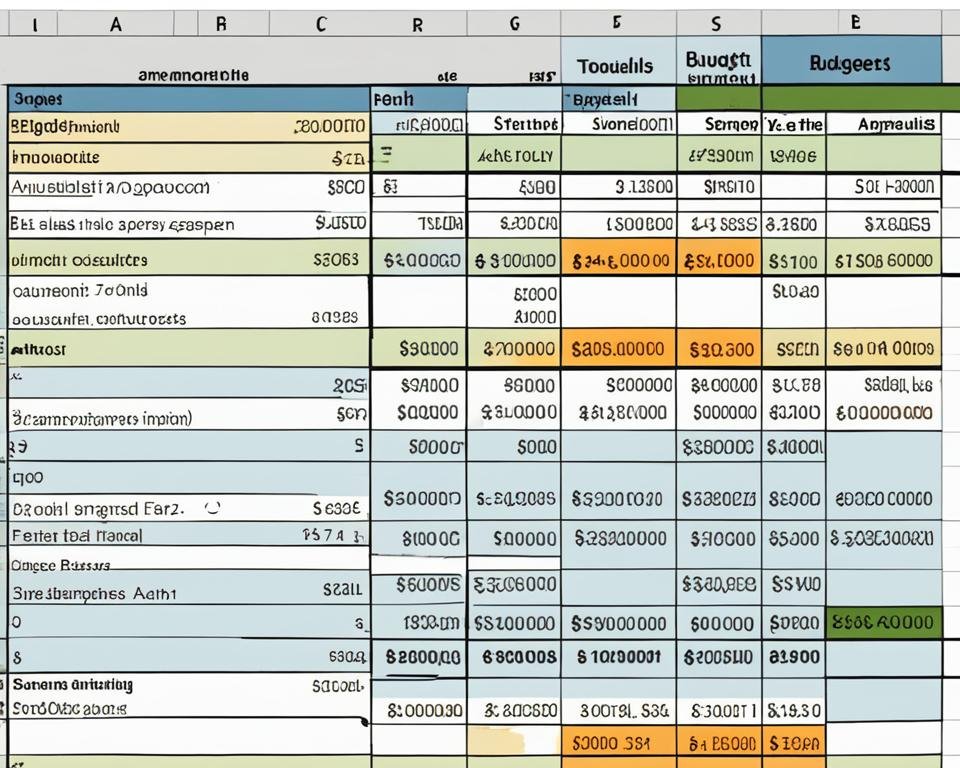

The image above provides a visual representation of a budget vs actual tracking system. By tracking your actual expenses and comparing them to your budget, you can identify where you are overspending and make adjustments to improve your financial situation.

The Importance of Tracking Budget vs Actual

Tracking budget vs actual is essential for businesses and individuals to manage their finances effectively. Knowing how your actual spending compares to your planned budget can help you make informed decisions about your expenses, whether you need to make adjustments and where you can save money.

By keeping a record of your budget and actual expenses, you can identify potential problems early, such as overspending in a particular area, and take action to correct them before they become major issues. This can help you avoid financial difficulties and achieve your financial goals.

"Tracking your expenses is a fundamental part of financial management. It allows you to be in control of your money, make good decisions, and avoid unnecessary debt."

A budget vs actual table or Excel template can help you organize your financial data effectively and make it easier to track your progress. By using a modular template, you can simplify your financial management process and minimize errors in your calculations.

Investing time and effort in tracking your budget vs actual can yield significant benefits for your financial stability, providing you with a clear picture of your financial health and progress toward your goals.

The Relationship between Tracking and Budgeting

Tracking your budget vs actual is closely linked to the budgeting process, providing you with insights into how you are sticking to your budget and where you may need to adjust your spending. By regularly monitoring your budget vs actual, you can ensure that your budget remains relevant and accurate, making necessary changes along the way to improve your financial management.

The budget vs actual process is an ongoing one, and regularly revisiting your budget and tracking your expenses can help you stay on track and achieve your financial goals.

Understanding Excel Templates

Excel templates are predesigned spreadsheets that can be customized for specific tasks and purposes. These templates offer a simplified and efficient way to manage financial data, track expenses, and analyze spending patterns.

With an Excel template for budget vs actual tracking, you can easily compare your expenses against your budget to gain valuable insights into your financial performance. By understanding these templates, you can ensure that your data is accurately recorded, quickly analyzed, and effortlessly presented.

Excel templates offer a user-friendly interface, making it easy for even those with limited experience to use them. In addition, there are a variety of free and paid templates that are available online, ensuring that there is something to suit every budget and requirement.

Common Features of Excel Templates

| Features | Description |

|---|---|

| Categories | Categories or expense types are used to organize transactions and make it easier to create accurate and detailed analyses. |

| Columns | Columns are used to record specific pieces of data such as date, description, amount spent, and amount budgeted. |

| Formulas | Formulas are used to automatically calculate data and generate summaries, eliminating the need for manual calculations and saving time. |

Excel templates are a flexible and versatile tool that can be customized to meet your unique needs and preferences. By understanding the key elements that make up these templates, you can create a tracking system that accurately reflects your financial situation and helps you achieve your financial goals.

Benefits of Using an Excel Template for Budget vs Actual Tracking

Utilizing an Excel template designed for budget vs actual tracking offers numerous benefits that can significantly improve your financial planning and analysis. Some of these advantages include:

- Simplicity: Excel templates are easy to use and require minimal technical skills or expertise, making them accessible to everyone.

- Customization: Templates can be customized to suit specific needs, allowing users to tailor the template to their financial tracking requirements.

- Accuracy: By automating calculations and reducing manual data entry, Excel templates ensure more accurate budget vs actual tracking.

- Efficiency: With real-time updates and easy-to-read data summaries, Excel templates streamline financial analysis and improve overall efficiency.

- Cost-Effective: Excel templates provide a cost-effective solution for budget vs actual tracking, eliminating the need for expensive financial software or services.

Whether you are an individual or a business, the benefits of using an Excel template for budget vs actual tracking are clear. With its user-friendly interface, customizable features, and powerful analytical capabilities, an Excel template is an essential tool for effective financial management.

Key Components of a Budget vs Actual Excel Template

An effective budget vs actual Excel template should have certain essential components to help simplify financial tracking and analysis. These components include:

- Categories: The budget vs actual Excel template should have distinct categories for income and expenses. This helps provide a clear overview of where your money is coming from and how it is being spent.

- Columns: Columns should be included for projected budget, actual expenses, and the variance between the two. This allows for easy comparison and identification of differences.

- Formulas: The template should be equipped with formulas that automatically calculate the variance between projected and actual budget, eliminating the need for manual calculations.

- Graphs and charts: Visual aids such as graphs and charts can provide a quick and easy way to understand and analyze the data in the budget vs actual Excel template.

- Notes and comments: Additional space for including notes and comments can help provide context and clarification for the data included in the template.

By including these key components in your budget vs actual Excel template, you can ensure a comprehensive and efficient tracking and analysis of your financial data.

How to Use a Budget vs Actual Excel Template

Using a budget vs actual Excel template is a simple and effective way to keep track of your finances. To get started, follow these step-by-step instructions:

- Download the budget vs actual Excel template: Start by downloading a pre-designed budget vs actual Excel template from a reputable source or create your own template from scratch.

- Open the template and customize it: Open the template in Excel and customize it to include your specific financial categories, such as income, expenses, and savings goals.

- Enter your financial data: Begin entering your financial data into the appropriate categories and columns. Be sure to include both your budgeted amounts and your actual spending or earnings for each category.

- Review your results: The template will generate automatic calculations and visualizations, allowing you to easily compare your budgeted amounts with the actual amounts spent or earned for each category. Use these insights to identify areas where you may need to adjust your spending or earnings in the future.

- Update your template regularly: To ensure accurate and up-to-date financial tracking, be sure to update your template regularly with new data.

By following these simple steps, you can easily track and compare your financial data with a budget vs actual Excel template.

Tips for Effective Budget vs Actual Tracking

Tracking your budget versus actual spending is vital for staying on track financially. Here are some valuable tips and best practices to ensure efficient and accurate budget vs actual tracking using an Excel template:

- Set Realistic Goals: Before you start tracking your budget, set realistic goals for yourself. This will help you stay motivated and track the right metrics.

- Be Consistent: Make it a habit to update your budget spreadsheet regularly. This will ensure that you always have an up-to-date overview of your finances.

- Categorize Your Expenses: Organize your spending into categories that make sense for you. This will help you identify areas where you might be overspending and make adjustments accordingly.

- Track Your Actual Spending: Make sure you track your actual spending accurately. Small inaccuracies can quickly add up and undermine the usefulness of your budget vs actual tracking.

- Use Formulas: Take advantage of Excel formula functions, such as SUM, AVERAGE, and COUNTIF, to quickly and easily generate insights from your data.

- Compare to Your Budget: Regularly compare your actual spending to your budget to identify areas where you are overspending or underspending. This will help you make informed decisions about your finances.

- Review Your Budget Regularly: Be sure to review and adjust your budget regularly. Your financial situation will likely change over time, and your budget should reflect that.

Customizing Your Budget vs Actual Excel Template

One of the benefits of using an Excel template for budget vs actual tracking is the ability to customize it to suit your specific financial tracking needs and preferences. Here are some tips on how to customize your budget vs actual Excel template:

1. Choose the Relevant Categories

Determine the categories that are relevant to your financial tracking and add them to the template. This could include income, expenses, savings, debts, investments, and more. You can also rename the existing categories to better reflect your financial situation.

2. Customize Columns and Formulas

You can customize the columns and formulas based on your financial data and analysis requirements. For example, you may want to add new columns to calculate percentage variances between the budgeted and actual figures. You can also adjust the formulas to change the way the data is presented and calculated.

3. Include Relevant Visuals

Visuals are a powerful tool for analyzing and interpreting financial data. Consider adding charts, graphs, or other visuals to help you better understand your budget vs actual data. You can also customize the formatting and style of the visuals to match your preferences.

4. Update Data Regularly

It is important to update your budget vs actual Excel template regularly to ensure that the data is accurate and up-to-date. You can set a schedule or reminder to update the data on a daily, weekly, or monthly basis. This will help you stay on top of your finances and make informed decisions.

Overall, customizing your budget vs actual Excel template can help you gain a better understanding of your financial situation and make more informed decisions. By adding the categories, columns, and visuals that matter most to you, you can create a personalized template that meets your specific needs.

Advanced Analysis with Budget vs Actual Excel Template

If you are looking to take your financial management to the next level, the budget vs actual Excel template can help provide advanced analysis of your financial data. By utilizing various features and tools available within the template, you can identify trends, make informed decisions, and optimize your financial planning.

One of the key advantages of the budget vs actual Excel template is its flexibility in analyzing data. The template allows you to manipulate and filter data in various ways, enabling you to view and compare financial information in a multitude of formats. This feature is particularly useful in identifying patterns, such as seasonal trends or changes in customer behavior, that can help inform your financial decisions.

Another benefit of the budget vs actual Excel template is the ability to perform complex calculations and data analysis using built-in formulas and functions. By leveraging these tools, you can create powerful reports and visualizations that offer deep insights into your financial performance. For example, you can use formulas to calculate year-over-year growth rates, analyze profit margins, or track expenses by category.

In addition, the budget vs actual Excel template can be customized to suit your specific financial tracking needs. You can add additional columns, categories, or data points to the template, allowing you to track a wide range of financial metrics. Additionally, you can create custom charts and graphs to visually represent your data in a clear and concise manner.

Overall, the budget vs actual Excel template is a powerful tool that can help you take your financial tracking and analysis to the next level. By leveraging its advanced features and customization options, you can gain deeper insights into your financial performance and make more informed decisions to drive the success of your business or personal finances.

Integrating Budget vs Actual Excel Template with Other Tools

Effective financial management requires the integration of various tools and systems to streamline the process. Fortunately, integrating your budget vs actual Excel template with other financial management tools is easy and can significantly enhance your financial tracking process.

One common tool that integrates well with the budget vs actual Excel template is financial analytics software. By importing financial data from your Excel template into the software, you can produce advanced reports and visualizations to gain more insights into your finances. This integration can help you identify trends, forecast future cash flows, and make informed financial decisions.

Another valuable tool to integrate with your budget vs actual Excel template is expense tracking software. This integration can help you automatically categorize, track, and analyze your expenses, giving you a more comprehensive view of your financial health.

Finally, integrating your Excel template with cloud storage services such as Google Drive or Dropbox can make it easier to collaborate on financial data with others in real-time. This can be particularly useful for businesses with multiple departments or teams that need to access financial data simultaneously.

Overall, integrating your budget vs actual Excel template with other financial management tools can streamline your financial tracking process and provide more comprehensive insights into your finances.

Conclusion

Tracking your budget vs actual expenses is a crucial aspect of financial management, and an Excel template can make this process much more efficient and effective. By using a budget vs actual Excel template, you can gain valuable insights into your spending habits, identify areas where you can cut costs, and make informed decisions about your finances.

Remember to customize your template to suit your specific needs and preferences, and integrate it with other financial management tools if necessary. By following the tips and best practices outlined in this article, you can ensure that your budget vs actual tracking is accurate, efficient, and beneficial for your overall financial health.

So don't wait any longer – start using a budget vs actual Excel template today and take control of your finances!

FAQ

What is budget vs actual tracking?

Budget vs actual tracking is a financial management practice that involves comparing actual expenses and revenues to the budgeted amounts. It helps businesses and individuals assess their financial performance and make informed decisions.

Why is tracking budget vs actual important?

Tracking budget vs actual is important because it provides insights into how well financial goals and targets are being met. It helps identify areas of overspending or underspending, enables proactive steps to be taken, and promotes better financial planning and control.

What are Excel templates?

Excel templates are pre-designed spreadsheets that provide a framework for specific tasks or calculations. They are convenient tools for organizing and analyzing data, including budgeting and financial tracking.

What are the benefits of using an Excel template for budget vs actual tracking?

Using an Excel template for budget vs actual tracking offers several advantages. It saves time by providing a ready-made structure, ensures accuracy with built-in formulas and functions, enables easy data entry and manipulation, and allows for personalized customization.

What are the key components of a budget vs actual Excel template?

A budget vs actual Excel template typically includes categories for income and expenses, columns for budgeted and actual amounts, and formulas to calculate variances and percentages. It may also include additional features like graphical representations and summary reports.

How do I use a budget vs actual Excel template?

To use a budget vs actual Excel template, start by entering your budgeted amounts for different categories. Then, regularly update the actual amounts as expenses and revenues occur. The template will automatically compare the two and provide variance analysis.

What are some tips for effective budget vs actual tracking with an Excel template?

To ensure effective budget vs actual tracking with an Excel template, it is recommended to regularly review and update the data, double-check formulas for accuracy, use clear and consistent labels, and take advantage of built-in features like conditional formatting and data validation.

How can I customize my budget vs actual Excel template?

You can customize your budget vs actual Excel template by adding or deleting categories, renaming labels, adjusting formatting, or creating additional sheets for different time periods or financial analyses. This allows you to tailor the template to your specific needs and preferences.

How can I perform advanced analysis with a budget vs actual Excel template?

To perform advanced analysis with a budget vs actual Excel template, you can use features like pivot tables, charts, and formulas to identify trends, analyze variances, and generate detailed reports. These tools help uncover patterns, make meaningful comparisons, and support informed decision-making.

How can I integrate a budget vs actual Excel template with other tools?

You can integrate a budget vs actual Excel template with other financial management tools by importing and exporting data, linking or embedding other files, or utilizing shared platforms or cloud services. This ensures seamless data flow, enhances collaboration, and optimizes your overall financial tracking process.